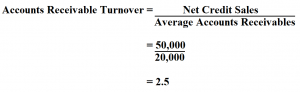

Net credit sales for the last 12 months were $3,500,000. In the beginning of this period, the beginning accounts receivable balance was $316,000, and the ending balance was $384,000. The controller of ABC Company wants to determine the company's accounts receivable turnover for the past year. Net Annual Credit Sales ÷ ((Beginning Accounts Receivable + Ending Accounts Receivable) / 2) Example of the Accounts Receivable Turnover Ratio Net credit sales are those sales generated on credit, minus all sales returns and allowances. To calculate receivables turnover, add together beginning and ending accounts receivable to arrive at the average accounts receivable for the measurement period, and divide into the net credit sales for the year.

ACCOUNT RECEIVABLE TURNOVER FORMULA HOW TO

How to Calculate the Accounts Receivable Turnover Ratio It is also useful for monitoring the overall level of working capital investment, and so is commonly presented to the treasurer and chief financial officer, who use it to plan funding levels. Since the accounts receivable turnover ratio is one of the better measures of accounting efficiency, it should be included in the performance metrics for the accounting department on an ongoing basis.

When the ratio is excessively low, an acquirer can view this as an opportunity to apply more vigorous credit and collection practices, thereby reducing the working capital investment needed to run the business. The accounts receivable turnover ratio can be used in the analysis of a prospective acquiree. It is useful to track accounts receivable turnover on a trend line in order to see if turnover is slowing down if so, an increase in funding for the collections staff may be required, or at least a review of why turnover is worsening. It is also quite likely that a low turnover level indicates an excessive amount of bad debt.

Low receivable turnover may be caused by a loose or nonexistent credit policy, an inadequate collections function, and/or a large proportion of customers having financial difficulties. A low turnover ratio represents an opportunity to collect excessively old accounts receivable that are unnecessarily tying up working capital. Understanding the Accounts Receivable Turnover RatioĪ high turnover ratio indicates a combination of a conservative credit policy and an aggressive collections department, as well as a number of high-quality customers. The ratio is used to evaluate the ability of a company to efficiently issue credit to its customers and collect funds from them in a timely manner. It is one of the most important measures of collection efficiency. Accounts receivable turnover is the number of times per year that a business collects its average accounts receivable.

0 kommentar(er)

0 kommentar(er)